Export subsidies are an important means of trade competition among countries, and this paper analyzes the actual implementation measures of export subsidy policies in Germany and Japan. In order to further measure the economic effect of export subsidies, we take the export tax rebate as a data sample, analyze the impact of export trade, and verify the relationship between the growth rate of export tax rebate and the growth rate of exports. Calculate the trade competitiveness advantage index, and use the regression test to quantitatively analyze the correlation between the trade competitiveness index and the export tax rebate. Use the GTAP model to analyze the impact of short-term and long-term export subsidies on the products of Germany and Japan, and explain the overall social welfare, product output, product import and export changes. Combined with the RCA index, the product export competitiveness advantages of Japan and Germany under the export subsidy policy are measured. In electronic communication equipment, the ARCA index of Germany against Japan reaches 0.0772 in 2022, which indicates that Germany has a certain comparative advantage over Japan in electronic communication equipment.

In international trade, export subsidies have been a free means of intervention in free trade, he unilaterally reduce the production costs of trade exporting countries, for their own enterprises in the international market to have a competitive advantage in price [1]. After 1998, strategic trade policy as a kind of selective trade protection has been adopted by the majority of countries, not only developing countries, most of the developed capitalist countries are also to The adjustment of their own industrial policy, the welfare level as a starting point for the use of export subsidies and other means to protect the comparative advantage of their own industries and the interests of their own producers [2].

Export subsidies refer to direct payments or tax exemptions or subsidized loans to domestic exporters or potential exporters, as well as low-interest loans to foreign buyers, so as to stimulate domestic exports [3]. In fact, export subsidies can be seen as a form of dumping, which many countries continue to provide in hidden or not-so-hidden forms, despite the fact that export subsidies are not legal under international agreements [4].

Why are export subsidies so popular? Many governments use export subsidies to promote the growth of export volumes, and measures like special tariff exemptions, low-interest loans, and export tax rebates are commonly used instruments. Export subsidies are used to provide cost advantages to domestic producers [5]. Such subsidies are aimed at reducing the price of exported products in the international market and thus boosting a country’s exports. Foreign consumers receive more benefits than domestic consumers in terms of lower foreign prices than domestic prices for subsidized exports. The direct effects of export subsidies on the domestic economy are twofold: the terms-of-trade effect and the export income effect. Subsidies are designed to lower the foreign price of domestic exports, so they are not favorable to the country’s terms of trade, but a decline in the price of exports generally stimulates export volumes [6]. If foreign demand for exports is elastic, the percentage increase in export volume will be greater than the percentage decrease in foreign prices, and the country’s export revenue effect will increase. Export trade subsidy policy is an important institutional arrangement and policy measure of the Chinese government to support and encourage exports.

Especially in recent years, along with the tax reform, China’s export subsidy system has been perfected, and the export trade subsidy plays a pivotal role in macroeconomic policy as an important policy to adjust the export structure and guide industrial upgrading. As an important trade policy tool, export trade subsidies effectively improve the competitive advantage of export commodities and promote domestic exports [7].

With the globalization of the economy and trade, free trade is an inevitable trend; however, in the international trade of some products, export subsidies have become an important means for some countries to encourage enterprises to export. In some cases of trade disputes, it even appears that both sides of trading countries use export subsidies to fight price wars, which seriously distort the real price of products and increase the burden of governments, taxpayers and consumers. Literature [8] quantitatively assessed how ESR subsidies affect competition and welfare between exporting countries and their trading country partners, and the study pointed out that ESR subsidies favor exports and provide a certain amount of trade protection for low-profitability countries. Literature [9] introduces the World Trade Organization on tariffs, the General Agreement on Trade regulation development history, and a detailed analysis of China’s trade subsidy policy to produce economic impacts, as well as the World Trade Group for trade subsidies and countervailing rulings and recommendations, aimed at international trade and economic conflict resolution to contribute to the force. Literature [10] describes the reasons such as geopolitical tensions that have driven changes in the rules of international cooperation in world trade, including that the rules for classifying subsidies as prohibited or actionable have changed, and discusses the solutions to the spillover effects of subsidies. Literature [11] examined the issue of the impact of exports on firm performance, pointing out that exports promote firm sales, firm value and social employment, and for small firms, the total value gained from export promotion benefits much more than, export promotion, export subsidies and other expenditures. Literature [12] conceptualized a mediated moderation framework for evaluating and analyzing how export-oriented productive capacity affects the export performance of small and medium-sized manufacturing firms in China, and the results of the analysis are realistic in that the marketing execution capability of manufacturing firms significantly affects the export performance of the firms. Literature [13] based on resource allocation, information efficiency and risk control channels reveals that reasonable government subsidies have positive significance for enterprise innovation, but too much subsidies also inhibit enterprise technological innovation to a certain extent.

Challenges to multilateral trade rules have led to an increase in the number of regional high-standard economic and trade agreements, all of which have had a significant impact on global trade. These new trends are both challenges and opportunities for China’s foreign trade, and it is particularly important to correctly analyze the changes in the competitiveness of China’s exports to various countries and take appropriate measures to actively respond. Literature [14] explored and examined the international competitiveness of Indonesian agricultural products based on the trade specialization competitiveness index (TSI) and the market penetration index (RCA) of the Trade Specialization Index (TSI), and examined the expenditure of Indonesian agricultural products to have a strong competitiveness, but not enough in terms of comparative advantage. Literature [15] assessed the association between India’s export level, productivity and the competitiveness of the Indian manufacturing industry, the study pointed out that India’s exports and manufacturing competitiveness show a positive correlation, and concluded that there is a need to improve the export capacity of Indian manufacturing firms, which will in turn enhance the competitiveness of the manufacturing industry. Literature [16] discusses the erroneous revelation of international competitiveness and trade in the literature in order to enhance the theoretical knowledge of trade competitiveness among the relevant stakeholders and proposes to introduce competitiveness and comparative advantage on top of the international comparative basis of the cost of production of each country. Literature [17] summarized the international trade performance of African countries by combining descriptive and inferential data analysis methods and found that African countries have very poor performance in the Logistics Performance Index (LPI), noting that any improvement in the LPI would help to increase the export share of African goods.

This paper analyzes the four components of export subsidies and clarifies the domestic and foreign economic and trade effects of export subsidies. It focuses on the implementation measures of the export subsidy policy of each country, in which the export tax rebate as a key factor that has a direct impact on exports, selects the export tax rebate data from 1995 to 2020 as a sample to carry out the empirical analysis of export trade competitiveness. The regression model is used to test the correlation between export tax rebates and the competitiveness of export products. The GTAP model is proposed to analyze the changes in the import and export scale of long and short-term export subsidy policies on the product trade between Germany and Japan. Taking high-tech products as an example, the ARCA index is used to analyze the product export competitiveness of Germany and Japan under the export subsidy policy.

Export subsidies are defined as “subsidies granted in law or in fact on the sole condition or one of a number of other conditions of export performance”. The relevant sources define “export subsidy” precisely as “a subsidy granted on the basis of export performance”. Thus, export subsidies are first subsidies and then “export-dependent”. Export subsidies for products are generally considered to have four elements: “subsidy provider”, “financial support”, “benefit” and “export performance” [18,19].

Subsidies are governmental acts, and the subject of a subsidy in the Agreement on Subsidies and Countervailing Measures (SCM Agreement) is a “government or public body”. The government is quite clear, and the main controversy in real life is the agency.

The various means of subsidization by the State are also numerous, and the scope of government subsidies is already very broad, and government subsidies also include subsidies by agencies, especially the financial subsidies that are still very much hidden, which carry out government functions through private agencies.

Export subsidies are created through the granting of economic benefits by governments to enterprises, but not all governmental actions that result in the granting of benefits to enterprises are subsidies. In order to clearly define export subsidies, the concept of “financial support” is used and its forms specified in the SCM Agreement to distinguish “the possibility of treating as a subsidy any governmental action that results in the granting of a benefit”. There are four forms of what constitutes financial support under the SCM Agreement.

First, there is a direct transfer of funds or a direct transfer of potential funds and liabilities.

Second, the government fails to collect or waives the collection of taxes that it would otherwise be required to collect.

Third, the government directly provides goods or services or purchases goods, except for public facilities.

Fourth, the government realizes the above three types of financial support through private structures or funding agencies.

The first three types of financial support are direct transfers of economic resources, such as funds, goods or services, from the government to private entities. And the fourth type of financial support is the government’s implementation of the above behaviors through an agency. Of course, these four types of financial support can not fully summarize the export subsidies in the form of government financial support, but in a certain sense to make the definition of export subsidies clearer. Because financial support is one of the government’s normal functional activities, the export subsidies in the form of financial support to make clear provisions, can reasonably distinguish between the government’s legal and illegal financial support, standardize the government’s behavior.

A benefit is an advantage, a preference, that the recipient receives. But how such a benefit or advantage is determined involves the question of the existence of a benefit. The concept of “benefit” centers on the recipient, not the grantor, and the benefit is the recipient’s benefit. The benefit of non-government spending, on the other hand, exists as long as the recipient actually receives a benefit from the financial assistance that is not available in the marketplace, whether or not the government incurs a cost for that benefit. Implicit in the existence of a benefit is a comparison with market conditions, and the benefit exists only if the recipient of the financial assistance is in a more favorable position after receiving the assistance than before. The market is the criterion for determining whether a “benefit” has been conferred.

“Subsidies granted in law or in fact on the sole condition or one of a number of other conditions of export performance”. “Export subsidy means a subsidy granted on the basis of export performance”. As can be seen from the two definitions, the most important feature of export subsidies is that they are “conditional on export performance”. Here, “conditional on export performance” can be divided into “de jure export performance” and “de facto export performance”. The difference between the two is that they are based on different grounds. “De jure de facto export performance” is based on laws, regulations and existing relevant documents. “De facto apparent export performance” is a determination based on facts.

Subsidies have a very significant impact on both the economy and trade. Subsidies include both productive and export subsidies. Productive subsidies can be further subdivided into direct subsidies, price support subsidies and countercyclical subsidies.

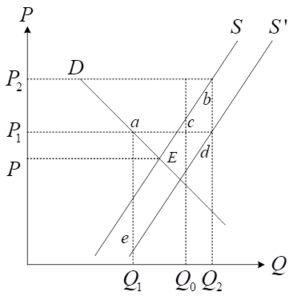

The economic effects of export subsidies are shown in Figure 1. In the absence of a subsidy, domestic price \(P\) is higher than world price \(P_{1}\). the domestic equilibrium point is point \(E\). at world price \(P_{1}\), domestic production is \(Q_{0}\), consumption is \(Q_{1}\), and exports are \(Q_{0}\)–\(Q_{1}\). with the imposition of a subsidy in the amount of \(P_{2}\)–\(P_{1}\) per unit of product, the domestic supply curve \(S\) shifts to the right and becomes \(S^{'}\). Also at world price \(P_{1}\), production becomes \(Q_{2}\), which leads to the conclusion that the economic and trade effects of the subsidy are:

Domestic consumption remains unchanged, production increases for and exports are stimulated by an increase in exports.

Domestic and international prices remain constant.

Social welfare decreases. Area a + b + c is a government subsidy, producer surplus increases to e + d, and domestic consumption surplus remains unchanged. Since b = c = d and a = c, the net loss is b.

Overall, the subsidy gives the home country’s product some price support, both in the domestic market and in the international market. It expands the output of the domestic product and puts it in a favorable position to compete in the market.

The WTO Agreement on Subsidies and Countervailing Measures (SCM Agreement) provides for a two-track system of remedies for subsidies, i.e., remedies obtained through the application of domestic and foreign countervailing legal procedures, and remedies obtained directly through the WTO’s Consultation and Dispute Settlement Mechanism (DSM).The WTO SCM Agreement states that it recognizes the positive role of subsidies in the socio-economic development of developing countries. As a result, special and preferential treatment is given to subsidies implemented by developing countries, including: treatment of export subsidies and differential treatment of countervailing measures.

Some export subsidy policies do promote exports and economic development. But there are more measures are not obvious, to a certain extent, a waste of financial resources, distorting the allocation of resources, not only unfair to domestic enterprises, but also to some export enterprises have brought the legal risk, so that there is the hidden danger of countervailing investigations.

These export subsidies can be roughly divided into the following three kinds:

First, local foreign investment policies and regulations for export performance subsidies.

The second is the tax reduction and exemption preferences for certain types of foreign-invested enterprises.

The third is the phenomenon of levying less and refunding more in export tax rebates.

The concept of export tax rebate is divided into narrow and broad sense. The export tax rebate in the narrow sense only refers to the refund of the domestic indirect tax that has been borne by the exported products, and the way of implementation is manifested as “levy first and then refund”. The broad sense of the export tax rebate, including not only the refund of indirect taxes paid, but also include exemption from the indirect taxes to be paid by the export products, the implementation of which includes “levy and then refund”, “tax exemption”, “tax exemption”, “exemptions and refunds The modes of implementation include “refund after levy”, “tax exemption”, “tax credit and tax refund”, etc.

In essence, “exemption from indirect taxes payable” and “refund of indirect taxes paid” are both consistent with the purpose of export tax rebates, which is to increase the competitiveness of national or regional products by allowing them to be exported at a price that does not include taxes. In practice, few countries simply adopt the “levy and then refund” method of export tax rebate. Most countries adopt the “exemption and refund” method, or two or more export tax rebate methods. Therefore, this paper adopts a broad concept of export tax rebate, and defines export tax rebate as, in order to enable export products to participate in the international market competition at tax-free prices, a government exempts or refunds the indirect taxes paid by the export products in the domestic production and circulation according to the law.

Export tax rebate should include the following features.

First of all, the object of tax rebate is export products.

Secondly, the object of refund is indirect tax.

Finally, the amount of refund is limited.

The export tax rebate system is a general term for a country’s legal regime governing export tax rebates. Export refunds are dependent on indirect taxes such as value-added tax (VAT) and consumption tax, so the export refund system of each country is usually included in the VAT law or other indirect tax legal provisions.

The nature of Germany’s VAT is a shared tax, with the federal government and local governments sharing the burden of VAT collection and refund. In order to solve the practical problem of contradictions between different levels of governments caused by shared tax, the German government has set up a specialized export tax rebate agency, and at the same time, it also continuously strengthens the coordination between the tax rebate agency and the outside, so as to achieve the purpose of better service for the taxpayers. On the other hand, in the management of the functional departments within the export tax rebate organization, Germany has set up a more perfect department with clear responsibilities and a clear division of labor.

In the distribution of VAT, Germany firstly adopts the unified collection by the federal government. On the basis of the deduction of export tax rebate, it is then distributed between the federal and local governments. This mechanism of distributing VAT according to the actual tax after deducting the export tax rebate can better solve the complicated contradictions in the central and local export tax rebate sharing mechanism.

Another feature of the German VAT sharing system is that the federal government and the state governments must first negotiate and finalize the proportion of VAT sharing, and the proportion determined here has the nature of distribution regulation.

First, the federal government calculates the average financial strength of each state, as well as its strengths and weaknesses and the level of transfer payments according to a uniformly determined formula.

Secondly, based on the above calculations, the sharing ratio is adjusted on a regular basis. This is because the adjustment originally takes into account the actual level of economic development and revenue capacity of each state. Moreover, the government has already made a more thorough consideration when determining the corresponding ratio. Therefore, although Germany’s VAT is a shared tax system, due to the principle of refunding the export tax rebate first and then distributing it, and the VAT sharing ratio is often adjusted according to the actual situation, it is not to a large extent a shared tax. Therefore, to a large extent, there is no contradiction between the central and local sharing mechanism.

This paper takes the export tax rebate which has a direct impact on export as an example to do empirical research on the influence of export trade.

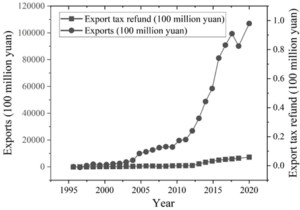

The growth rate of export tax rebates and the growth rate of exports are shown in Figure 2. It can be judged that the export tax rebate growth rate and export growth rate are roughly positively correlated. When the tax rebate growth rate increases, the export volume increases. In 1997, when the growth rate of export tax rebate decreased to -46.936%, the export growth rate also decreased to 1.024%. In addition, since the reform of the export tax rebate mechanism in 2004 until now, the direction of change of the export growth rate and the direction of change of the export tax rebate growth rate almost show a high degree of consistency. Of course, the change of export volume is much more drastic than the change of export tax rebate rate, indicating that export tax rebate is only one of the factors affecting the growth of export trade, and there are other factors affecting the change of export trade.

From the beginning of the implementation of the export tax rebate policy to the present, the export tax rebate has played a great role in promoting the competitiveness of export products and the development of export trade, and has now become one of the important policy instruments of macro-control.

Changes in total exports reflect to a certain extent the overall competitive advantage of export products, and exports have always been an important factor driving economic development.

During the period of 1995-2020, the trend of changes in the amount of export tax rebates and the amount of export trade basically remained consistent. the scale of export tax rebates and the scale of exports from 1995 to 2020 are shown in Figure 3.

Before 2000, both of them maintained slow growth. With the accession to the World Trade Organization, the export trade has been developed rapidly, and in 2020, the export trade volume will be RMB 112,054.70 billion.During the 11-year period from 2000 to 2010, the export trade volume increased by an average of RMB 930,517 billion per year, and the tax rebate volume increased by an average of RMB 63,514.1 billion per year.

The horizontal division of labour indicator” is the Trade Competitiveness Advantage (TC), which shows the international division of labour for each commodity and is a fairly common measure of international competitiveness. The formula is as follows: \[\ TC_{ij} =(X_{ij} -M_{ij} )/(X_{ij} +M_{ij} ), \tag{1}\] where \(TC_{ij}\) represents the international trade competitiveness advantage index for the \(j\) products of \(i\) countries. \(X_{ij}\) represents the export value of \(j\) products of \(i\) countries. \(M_{ij}\) represents the import value of \(j\) products of \(i\) countries.

From the viewpoint of the overall competitiveness index of export trade, the export competitiveness basically shows a trend of continuous improvement from 1995 to 2020.In 1995, the total exports only accounted for 1.45% of the world’s total exports and the trade competitiveness index (TC) was -0.25, which indicates that the overall export competitive advantage was weak at that time, and the balance of payments was in a deficit situation.

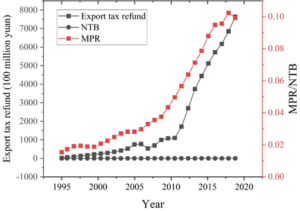

The indicators of export tax rebates and export competitiveness from 1995 to 2020 are shown in Figure 4. Clear policy preferences accelerated the development of export trade, and the share of export trade in total world trade expanded after 1995.The MPR fluctuated slightly around 2020, remaining within the range of 0.09 to 0.10. Overall, the linear relationship between the amount of export tax rebates and the MPR indicator and TC indicator is more obvious during the sample period.

Next, the interaction between them is quantitatively analyzed by regression test. In order to reduce the absolute value gap between the indicators and eliminate the heteroskedasticity of the data, the logarithmic treatment of the export tax rebate is still carried out.

The positive relationship between the logarithm of export tax rebate and export competitiveness in the examination period is still more obvious, firstly, we can basically judge that the LTR and MPR indexes are quadratic function relationship from the above figure, and the regression results can be obtained through calculation: \[\ MPR_{i} =0.0887-0.0348LTR_{t} +0.0054LTR_{t}^{2} . \tag{2}\]

The t-statistics of the parameters are shown in parentheses in the equation, and the test is significant at the 0.01 level of significance for each parameter. The regression F-statistic is 593.04 and the adjusted \(r^{2}\) is 0.986, indicating that the regression equation is valid in its entirety and that the regression explains 98% of the total sum of squared deviations. Full differentiation of Eq. yields: \[\ dMPR_{t} =(0.0085LTR_{t} -0.0348)\frac{dMPR_{t} }{LTR_{t} } . \tag{3}\]

Let \(\xi\)= 0.0085\(LTR_{t} -0.0348\), denotes the semi-elasticity of export market share to the amount of export tax rebate, i.e., every 1% increase in export tax rebate can increase the world market share of exported products by \(\xi\) .

Substituting the relevant data from 1995 to 2020 into the expression of \(\xi\), the change of the value of semi-elasticity from 1995 to 2020 is shown in Table 1. 1995-2010 \(\xi\) basically stays between 0.0015-0.0300, and after the accession to the World Trade Organization, the role of the export tax rebate on the competitiveness of exports is further improved, and in 2015 \(\xi\) has exceeded the level of 0.0300.

| YEAR | 1995 | 2000 | 2005 | 2010 | 2015 | 2020 |

| \(\xi \) | 0.0015 | 0.0135 | 0.0185 | 0.0245 | 0.0375 | 0.0395 |

Preliminary test of the relationship between the two, the regression results of trade competitiveness index and export tax rebate are shown in Table 2.

Regression equation (1), the significance of the estimated parameters is high and the sign is consistent with the theoretical judgment, but the DW statistic shows that there is autocorrelation in the residuals, and the test shows that the residuals are first-order autocorrelation. By comparing different methods of eliminating autocorrelation, it is found that adding the lag of the logarithm of export tax rebates yields more satisfactory results, as shown in regression equation (2). The estimates of each parameter are significant at a high confidence level, and the adjusted decidable coefficients are also improved and the model passes the correlation test of the residuals. The parameter corresponding to the logarithm of export tax rebate in regression equation (2) is still semi-elastic, and the result affirms the promotion effect of export tax rebate on trade competitiveness as well as reflects the role of export tax rebate with a certain lag. A 1% increase in the current export tax rebate will reduce the trade competitiveness index by -0.00226115 in the same period, because exporters, in order to maximize profits, will reduce the current export volume when they form a clear expectation of an increase in the export tax rebate, which will lead to a decline in the trade competitiveness index. When the export tax rebate actually occurs after the increase will promote enterprises to increase exports, and thus improve the export competitiveness of products, the last period of the export tax rebate increase of 1% will be when the current period of the TC index increased by 0.00213569.

Comprehensive analysis of the above, the export tax rebate on the overall competitiveness of export products in the international market has a certain role in promoting, in the case of not violating the principle of fair competition and fiscal balance allows, increase the export tax rebate can improve the product’s international market share and trade competitiveness, and at the same time with the trade competitiveness index of the relationship between the test shows that there is a certain lag in the role of the export tax rebate policy.

| Trade competitiveness index | ||

| Regression (1) | Regression (2) | |

| Constant term | -0.239569**(-5.369945) | -0.085969**(-2.350048) |

| Export tax rebate | 0.042589** (6.389542) | -0.226115** (-4.577632) |

| The return of the export tax rebate is delayed | – | 0.213569*** (6.035253) |

| After adjustment | 0.593621 | 0.7266339 |

| F statistic | 32.744961 | 25.426631 |

| DW statistic | 0.893224 | 1.536784 |

GTAP is one of the typical models of general equilibrium models, which constructs sub-models for different subjects by analyzing the production, consumption, and expenditure behaviors of individual countries using a series of methods such as the Armington hypothesis. These models are then linked together to build a general equilibrium model involving multiple countries and multiple sectors.

In this section, the number of tariffs as well as non-tariff barriers will be selected as shock variables, and the GTAP model will be used to analyze the impact of export subsidies on products in the short and long term, and to illustrate this in terms of overall social welfare, product output, and changes in product exports and imports.

GTAP countries and regions are delineated as shown in Table 3. In order to clarify the changes in product imports and exports among the major trading partners after the export subsidies take effect, this paper divides the 141 countries or regions in the GTAP 10.0 database into China, Japan, South Korea, Australia, New Zealand, ASEAN, the European Union, the U.S., and the rest of the world, with a total of nine regional groups.

| Numbering | Region | For short |

| 1 | China | China |

| 2 | Japan | Japan |

| 3 | Germany | Germany |

| 4 | South Korea | Korea |

| 5 | Australia | Aus |

| 6 | New Zealand | NZ |

| 7 | The United States | USA |

| 8 | Other areas | OTH |

RCEP, or Regional Comprehensive Economic Partnership Agreement, aims to promote regional economic, trade and investment development by cutting tariffs and non-tariff barriers and building a high-quality, modernized, comprehensive and mutually beneficial partnership.

The RCEP agreement officially comes into force in 2022, and so this paper sets 2021 as the base year for the simulation forecast. Based on the updated GTAP10.0 database, this paper will simulate and forecast the import tariff tax intensity as a policy shock variable in the short-term simulation process, and the import tariff tax intensity and the implementation intensity of non-tariff measures as policy shock variables in the long-term simulation process.

Importing the above relevant data, as well as the short- and long-term scenarios into GTAP, one can obtain forecasts of the economic indicators associated with short-term tariff reductions and long-term tariff and non-tariff barrier reductions for the countries of the region. The results show that overall the entry into force of export subsidies leads to positive economic effects on product trade, but there are differences in the direction of change in the sub-product sectors.

The overall economic welfare changes are shown in Table 4. In terms of changes in trade volume, Japan, Germany, and Australia show an increasing trend in the size of exports and imports in both the short and long term. German exports were -0.18% and -0.15% in the long and short term respectively. While New Zealand’s import and export show a decreasing trend in the short term, the long term is alleviated and shows an increasing trend.

It is worth mentioning that among the RCEP members, Japan’s trade growth is the most obvious. Long-term imports increased by 7.85% and exports increased by 8.73%. In comparison, China’s short-term imports and exports grew by 2.36% and 2.15% respectively, far less than Japan. The possible reason for this is that, from the perspective of trade volume, China’s own product trade base is large and total, so the magnitude of growth change is not obvious. From the perspective of trade liberalization and facilitation, China has signed bilateral or multilateral FTAs with all RCEP members except Japan, and has established relatively solid trade ties with each other, so the room for trade growth is limited to a certain extent.

Overall, RCEP’s commitment to reduce product tariffs has had a positive impact on four countries – Japan, Germany, Australia and New Zealand – and some negative impact on ASEAN. However, most of the negative impacts will be mitigated in the long run. The possible reasons for this phenomenon are, on the one hand, the disparity in natural conditions and production costs among the countries in the region, which leads to low and difficult to increase production capacity, thus affecting the movement of macro indicators. On the other hand, with reference to the schedule of tariff commitments and the relevant agreements signed by the countries in the region in the past, it can be seen that Australia and New Zealand have basically realized zero tariffs on agricultural products at this stage. And the tariff level in the effective period of the agreement for a longer period of time to occur a substantial decline, the loss of protection for some agricultural products, and thus the relevant indicators will be hit. However, it is possible that the rate of tariff reduction is not as large as that of Japan and South Korea, and thus the welfare growth is limited. For Japan and South Korea, the entry into force of RCEP will be the first time that Japan concludes an FTA with its major trading partner, South Korea. Moreover, the magnitude of the tax cuts in Japan and South Korea is also relatively large, so the increase in welfare levels in Japan and South Korea is significant.

| Correlation index | Trade conditions (%) | Welfare ($million) | Import (%) | Export (%) | ||||

| Short term | Long term | Short term | Long term | Short term | Long term | Short term | Long term | |

| China | -0.45 | -0.21 | 2126.25 | 2759.64 | 2.36 | 2.78 | 2.15 | 3.46 |

| Japan | 1.62 | 1.35 | 196849.65 | 23245.78 | 7.24 | 7.85 | 8.41 | 8.73 |

| South Korea | 1.21 | 1.29 | 11256.69 | 9255.43 | 6.69 | 6.24 | 4.48 | 5.04 |

| Australia | -0.45 | 0.11 | 635.23 | 936.18 | 3.25 | 3.76 | 0.59 | 0.78 |

| New Zealand | -1.69 | 0.56 | -520.66 | 189.54 | -2.21 | 1.36 | -0.22 | 1.32 |

| The United States | -0.25 | -0.21 | -5598.63 | -5979.02 | -0.57 | -0.46 | -0.24 | 0.63 |

| Germany | -0.09 | -0.10 | -2136.22 | -2303.75 | -0.37 | -0.49 | -0.15 | -0.18 |

| Other areas | -0.18 | -0.21 | -8663.01 | -8565.44 | -0.43 | -0.48 | -0.26 | -0.37 |

The index of demonstrated comparative advantage (RCA) is one of the most common indices of trade competitiveness, and refers to the ratio of the share of an economy’s exports of a particular commodity in the value of its total exports to the share of exports of that commodity in total world exports. It reflects an economy’s comparative advantage in exports of a particular commodity relative to other economies. It can be expressed by the formula: \[\ RCA_{ij} =(X_{ij} /X_{ij} )/(X_{iw} /X_{tw} ) , \tag{4}\] where \(RCA_{ij}\) is the index of comparative advantage for country \(j\)’s \(i\) products. \(X_{ij}\) and \(X_{ij}\) are the export value of \(i\) products of country \(j\) and the total export value of all products of country \(j\), respectively. \(X_{iw}\) and \(X_{nv}\) are world exports of \(i\) products and total world exports of all products, respectively.

It is generally believed that a country’s RCA index is greater than 2.5, indicating that the country has a strong export advantage of this product, RCA in [1.25, 2.5], indicating that the country has a strong export advantage of this product, RCA is [0.7, 1.25], indicating that the country has a certain degree of export advantage of this product, but the advantage is not obvious. An RCA of less than 0.7 indicates that the country has only a weak or even no export advantage for this product.

It can be noted that the shortcoming of the RCA index is that it is not symmetric; the RCA has a set lower bound of 0 and a midpoint of comparative advantage of 0.7, but its upper bound is not bounded. This means that the same size RCA value may indicate different levels of comparative advantage for different goods in different countries. Overall, the RCA index does not reflect the dynamics of comparative advantage well.

Considering the shortcomings of the RCA index, this paper draws on the Additional Revealing Comparative Advantage Index (ARCA index), which is best characterized as symmetrically distributed. This type of index combines the traditional RCA index with regional entropy, which greatly demonstrates export specialization and avoids some of the inherent drawbacks present in the RCA index. The algorithm is as follows: \[\ ARCA_{i,AB} =\frac{X_{i,AW} }{X_{t,AW} } -\frac{X_{i,BW} }{X_{t,BW} } . \tag{5}\]

This is an example of country A’s and country B’s \(i\) products, and \(ARCA_{i,MB}\) is country A’s ARCA index for country B’s \(i\) products. \(X_{i,AW}\) refers to country A’s exports of \(i\) products to the world, and \(X_{t.AW}\) refers to country A’s exports of all products to the world. \(X_{i.BW}\) refers to country B’s exports of \(i\) products to the world, and \(X_{t.BW}\) refers to country B’s exports of all products to the world.

The ARCA index values are all within [-1, 1], and the distribution also shows symmetry, and the center point of its comparative advantage is 0. When the ARCA index is negative, it means that country A has a comparative disadvantage to country B in \(i\) products, and the products are not competitive. Conversely, it means that country A has a comparative advantage over country B and the product is competitive.

Germany’s ARCA index of high-tech products to Japan is shown in Figure 5, which shows the ARCA index of eight high-tech products to Japan. Figures 5(a) and 5(b) show the ARCA indices for (i) aerospace equipment, (ii) computer equipment, (iii) electronic communication equipment, and (iv) pharmaceuticals, (v) scientific instruments, (vi) electronic equipment, (vii) chemicals, and (viii) non-electronic equipment, respectively.

These eight high-technology products can be divided into three categories, the first being products of comparative advantage. The second category is the superior and inferior conversion products. The third category is comparative disadvantage products.

The first category is computer equipment, pharmaceuticals and chemicals. It is easy to see that in pharmaceuticals and chemicals, although the ARCA index is positive, but only 0.0004 and 0.0027 in 2017. The content of the level of science and technology is not much ahead of Japan. Only the ARCA index of computer equipment is 0.07, which indicates that Germany’s computer products have a certain comparative advantage over Japan.

The second category is electronic communications equipment, Germany in 2003-2006 the two years of the ARCA index is negative. But in 2007 it turned from negative to positive, and by 2022 its ARCA index reached 0.0772, which indicates that Germany also has a certain comparative advantage over Japan in electronic communications equipment.

The third category of products electronic equipment, non-electronic equipment, scientific instruments and aerospace equipment, Germany has no comparative advantage in these products. Analyzed from the data, Germany in electronic equipment and non-electronic equipment due to the small scale of trade, so the comparative disadvantage is not obvious. But the trade volume of aerospace products and scientific instruments is very large, so the comparative disadvantage is obvious, which shows that Germany has a great disadvantage with Japan in aerospace and scientific instruments.

This paper analyzes the implementation measures related to the export subsidy policy, and takes the growth rate of export tax rebate and the growth rate of exports from 1995 to 2020 as the sample data for analysis, and empirically analyzes the relationship between the export tax rebate and the trade competitiveness of export products. And further analyze the export trade competitiveness level of Germany and Japan under the implementation of export subsidy policy with GTAP model and ARCA index.

The growth rate of export tax rebate and export growth rate from 1995 to 2020 are roughly positively correlated, and the trends of export tax rebate and export trade volume change are basically consistent. From the perspective of the overall competitiveness indicators of export trade, the export competitiveness in 1995-2020 basically shows a trend of continuous improvement.

Construct the GTAP model of Germany and Japan’s long and short-term export subsidy policy on national trade competitiveness. In terms of overall economic welfare, the long and short-term export subsidy policy helps the development of import and export in Japan and Germany, and the scale of import and export both show an increasing trend.

The ARCA index under the export subsidy policy shows that Germany’s computer products and electronic communication equipment have a certain comparative advantage over Japan. Germany has no comparative advantage in electronic equipment, non-electronic equipment, scientific instruments and aerospace equipment.

Ortigueira-Sánchez, L. C., Welsh, D. H., & Stein, W. C. (2022). Innovation drivers for export performance. Sustainable Technology and Entrepreneurship, 1(2), 100013.

Abbas, S., & Waheed, A. (2017). Trade competitiveness of Pakistan: evidence from the revealed comparative advantage approach. Competitiveness Review: An International Business Journal, 27(5), 462-475.

Yoo, J. H. (2017). Korea’s Rapid Export Expansion in the 1960s: How It Began. KDI Journal of Economic Policy, 39(2), 1-23.

Popescu, G. H., Nicoale, I., Nica, E., Vasile, A. J., & Andreea, I. R. (2017). The influence of land-use change paradigm on Romania’s agro-food trade competitiveness—An overview. Land Use Policy, 61, 293-301.

Saputri, A. S., Syarif, R. I., & Nusantara, H. A. (2019, September). Evaluation of the Indonesian Log Timber Export Prohibition Policy and Proposed Potential Alternative Policies to Minimize Subsidy Allegations. In International Conference on Trade 2019 (ICOT 2019) (pp. 206-210). Atlantis Press.

Crouch, G. I., & Ritchie, J. B. (1999). Tourism, competitiveness, and societal prosperity. Journal of business research, 44(3), 137-152.

Wysokińska, Z. (2017). Effects of Poland’s pro-export policy implementation in the context of the plan for responsible development: A preliminary comparative assessment. Comparative Economic Research. Central and Eastern Europe, 20(4), 101-123.

Defever, F., & Riano, A. (2017). Subsidies with export share requirements in China. Journal of Development Economics, 126, 33-51.

Bown, C. P., & Hillman, J. A. (2019). WTO’ing a Resolution to the China Subsidy Problem. Journal of International Economic Law, 22(4), 557-578.

Hoekman, B., & Nelson, D. (2020). Rethinking international subsidy rules. The World Economy, 43(12), 3104-3132.

Munch, J., & Schaur, G. (2018). The effect of export promotion on firm-level performance. American Economic Journal: Economic Policy, 10(1), 357-387.

Wang, X., Chen, A., Wang, H., & Li, S. (2017). Effect of export promotion programs on export performance: evidence from manufacturing SMEs. Journal of Business Economics and Management, 18(1), 131-145.

Liu, D., Chen, T., Liu, X., & Yu, Y. (2019). Do more subsidies promote greater innovation? Evidence from the Chinese electronic manufacturing industry. Economic Modelling, 80, 441-452.

Firmansyah, F., Widodo, W., Karsinah, K., & Oktavilia, S. (2017). Export performance and competitiveness of indonesian food commodities. JEJAK: Jurnal Ekonomi dan Kebijakan, 10(2), 289-301.

Sahoo, P. K., Rath, B. N., & Le, V. (2022). Nexus between export, productivity, and competitiveness in the Indian manufacturing sector. Journal of Asian Economics, 79, 101454.

Abbott, P. C., & Bredahl, M. E. (2019). Competitiveness: definitions, useful concepts, and issues. In Competitiveness in international food markets (pp. 11-35). CRC Press.

Buvik, A. S., & Takele, T. B. (2019). The role of national trade logistics in the export trade of African countries. Journal of Transport and Supply Chain Management, 13(1), 1-11.

Tanapong, P., & Wisarut, S. (2022). Why does the WTO treat export subsidies and import tariffs differently?. Review of World Economics(4),1-36.

Kyoungwon, R., & Moonsung, K. (2019). Export Subsidies and Least Developed Countries: An Entry-Deterrence Model under Complete and Incomplete Information. Korean Economic Review(1),163-182.